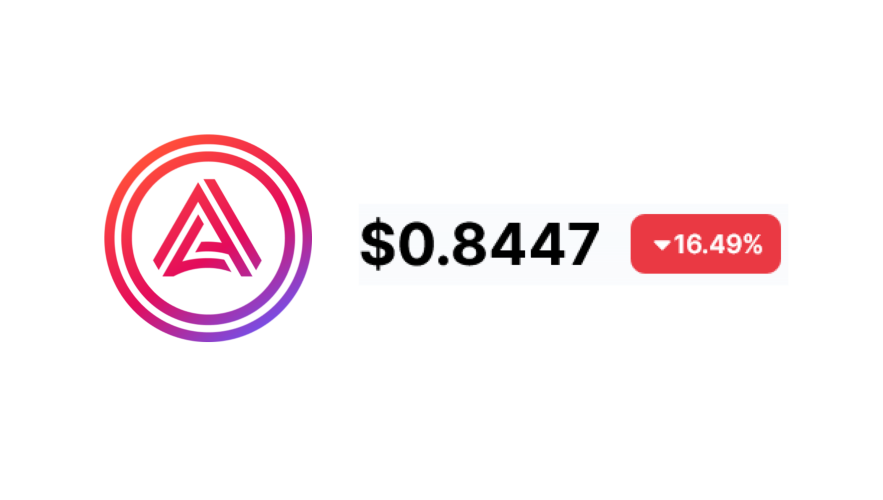

Polkadot-based Stablecoin Acala USD Depegs after $1 Billion Exploit

Polkadot is an ecosystem often thought of to be an evolution of many blockchain ideas. While it has shown some strength in certain areas, one of its top DeFi protocols, Acala, was involved in a massive exploit today. As a result, the price of AUSD has depegged, fluctuating between 80 and 95 cents at the time of writing this. Acala is a Polkadot parachain which involves a cross-chain stablecoin protocol known as Honzon.

While it's not known how the exploit occurred, unknown attackers has managed to print over 1 billion AUSD. Binance CEO Changpeng Zhao confirmed this in a tweet. The only information the Acala team could initially give was that Acala's Honzon protocol had seen configuration issues and that an urgent vote had been passed to pause all operations on the Acala network.

We have noticed a configuration issue of the Honzon protocol which affects aUSD. We are passing an urgent vote to pause operations on Acala, while we investigate and mitigate the issue. We will report back as we return to normal network operation.

— Acala (@AcalaNetwork) August 14, 2022

After further investigation, the Acala team found out there was a configuration error in the iBTC/aUSD liquidity pool, which allowed the attackers to erroneously mint the stablecoin. The team froze the relevant addresses to prevent the funds from being sold for fiat on a centralized exchange. In addition, the team is burning the hacked funds

The crypto community has been plagued with unrest concerning stablecoins. In May, popular DeFi protocol Terra depegged after a series of issues and the failure of its leadership. The Polkadot ecosystem has been largely reliable since its inception, so this exploit is causing a rush of concern in the community. You can bet the SEC is watching this situation unfold with great interest.

*This story has been updated to include that the hacked funds have been frozen among other new developments from the Acala team.