Learn

This page contains valuable resources to help navigate you through the basics of Bitcoin, smart contracts and other top projects, as well as help you avoid common pitfalls of the blockchain industry.

Table of Contents

Bitcoin

Overview

Bitcoin is the world's first cryptocurrency developed in 2008 by Satoshi Nakamoto with a focus on security, decentralization, and social scalability. As a result of Bitcoin's strong economics and powerful immutable properties like Nakamoto consensus, it has remained the #1 cryptocurrency by market cap.

The ethos of Bitcoin is rooted in limiting network changes and keeping as many full nodes as possible to minimize trust and ensure decentralization on a global scale.

Possible Origins

Importantly, the precursors of Bitcoin were devised by extropians involved in the cypherpunk movement. It all started on a private mailing list launched by computer scientist Nick Szabo, who added cypherpunks Hal Finney, Wei Dai, Tim May, and economists George Selgin and Larry White.

The Libtech mailing list also happens to be where Nick Szabo invented Bit gold and Wei Dai invented B-Money.

Satoshi Nakamoto is a mysterious individual who shielded his identity through strong OPSEC skills. However, the most convincing evidence appears to point in the direction of the West Coast and the same circle that introduced Bitcoin's core ideas. Fascinatingly, B-Money was cited by Satoshi in the Bitcoin whitepaper, while Bitcoin's far closer analog, Bit gold, was not.

This is broadly seen as strange because Szabo asked for Bit gold contributors in a blog post 6 months before the paper's release, but also implied that someone other than the government should implement a currency better than Bit gold.

Details like these, and its feature of miners solving complex puzzles that are timestamped and chained together in perpetuity, resulted in extensive research I conducted into Szabo's possible role in the creation of Bitcoin.

My research indicated that Szabo possibly designed Bitcoin, and may have enlisted the help of a select few to steer the project forward with him. There are other possible scenarios too, but I think Szabo was likely involved in some capacity.

In addition, other people have been suggested, such as computer scientists Wei Dai and James Donald, both of whom one can make strong cases for. Ultimately, whoever Satoshi is, he did an impressive job of creating the most secure, trust minimized monetary instrument in history.

Security

Besides its verifiable scarcity (which I touch on next), Bitcoin's success is linked to its immense level of security. Bitcoin achieves its impressive security through a breakthrough in distributed network research called Nakamoto Consensus, which was designed by Satoshi Nakamoto.

Specifically, Nakamoto Consensus is Bitcoin's consensus protocol that involves miners competing to solve a timestamped proof-of-work (PoW), which adds a block of transactions to the never-ending cryptographic hash chain. This approach establishes the longest chain of PoW as the authoritative chain, making it extremely difficult for attackers to launch a successful 51% attack, as they would require control over 51% of the network's mining power to create a longer chain.

Economics

Bitcoin's design follows a unique form of Austrian economic theory, which was brought to the world by Nick Szabo. Specifically, Szabo extended the famous Austrian economists Ludwig von Mises and Carl Menger.

In 2002, Szabo published a monumental paper, "Shelling Out: The Origins of Money," outlining how ancient civilizations utilized trust minimized, decentralized, and unforgeably costly money, such as shells and precious metals. This quote from the piece serves as a perfect analog for Bitcoin's economic model:

"A collectible was not just any kind of beautiful decorative object. It had to have certain functional properties, such as the security of being wearable on the person, compactness for hiding or burial, and unforgeable costliness. That costliness must have been verifiable by the recipient of the transfer – using many of the same skills that collectors use to appraise collectibles today."

To tie in Bitcoin, miners in a decentralized network expend energy (incurring cost) to solve a timestamped proof-of-work puzzle, adding a block of transactions to the perpetual chain and receiving BTC as a reward (also through transaction fees).

Bitcoin's unforgeable costliness (analogous to gold mining) demonstrates that the supply curve is constrained, leading to a provably scarce currency that appreciates over time. Furthermore, Bitcoin adjusts for inflation through halvings, which ensure stability and growth by reducing the block reward roughly every 4 years by half. This will continue until there is no more Bitcoin left to mine in 2140, when transaction fees will serve as the main incentive for miners.

Full nodes (part of a growing network) further decentralize the network by verifying transactions and blocks while keeping full copies of the blockchain. Decentralization is vital to maintain Bitcoin's monetary properties and ensure censorship resistance.

Bitcoin's design proves that the coins were not forged and thus minimizes trust by not relying on a central authority to issue the money. In addition, like the trust minimized money of old, Bitcoin's unforgeable costliness (through mining) and verifiable scarcity give it value, not aesthetics or central banks.

Szabo strongly reiterates his theory 6 months before the whitepaper in "Bit gold Markets:"

"There are plenty of metals that are as shiny and smooth as gold, but people don't demand them as a store of value or medium of exchange because they are common. There are plenty of rocks that look as good as diamonds, but "diamonds are a girl's best friend" because they are hard to obtain and thus hold their value. Value comes to attach to the unique aesthetic features of gold or diamonds because these features signal scarcity. The value of precious metals or gems as stores of value, media of exchange, or even as cultural icons does not come from these aesthetic features, it is only [signaled] by them. It is their secure scarcity, not their aesthetic features, that allows them to be more securely used as a store of value and thus gives them a monetary value, and often a corresponding emotional and cultural value, far above the often trivial value they would have if they had the same aesthetics but were common."

You can see Satoshi using the same economic theory:

Social Scalability

Nick Szabo has performed substantial research into social scalability, a key part of Bitcoin's success. Szabo described this crucial concept in a 2017 blog post:

"Social scalability is the ability of an institution –- a relationship or shared endeavor, in which multiple people repeatedly participate, and featuring customs, rules, or other features which constrain or motivate participants’ behaviors -- to overcome shortcomings in human minds and in the motivating or constraining aspects of said institution that limit who or how many can successfully participate."

Bitcoin is not successful because of its computational scalability, which is intentionally poor. Its success is rooted in the fact that users do not have to deal with human bottlenecks like middlemen and neo-governance, leading to the greatest social scalability seen in any currency in history.

Many altcoins have neo-governance structures where participants vote on important issues and pass certain measures.

The problem is, when you incorporate such designs into the protocol, you lose social scalability due to a "Lord of the Flies" scenario where governance participants battle over the future of the blockchain, often leading to centralization and instability.

This is analogous to a public company with shareholder votes—something you may want to avoid in the blockchain space. I wrote about a proof-of-stake altcoin exhibiting this behavior here.

Hello Kitty people

In a 2006 blog post, Nick Szabo coined the term, "Hello Kitty people," for individuals who would rather rely on faulty human decision making than algorithms for things like the Google search engine. Szabo brilliantly emphasizes how automation has greatly benefited our species, like for example in medieval times where mechanical clocks replaced less-accurate time-keeping methods like sundials. Another example is when electrical telegraphy replaced older communication methods like message by horse in the 1840s.

Importantly, we can see this same trend play out in Bitcoin. Rather than trusting the erroneous decision making of central banks, which can lead to hyperinflation at any time, Bitcoin automates the process through a programmed 21 million cap, utilizing a network of computers to reach consensus.

Tips

Give the whitepaper a read: nakamotoinstitute.org/static/docs/bitcoin.pdf

And next, indulge in all the brilliant work that made Bitcoin possible: nakamotoinstitute.org/literature

Read Satoshi's body of work: nakamotoinstitute.org

Brief introduction of the Lightning Network, a layer 2 scaling solution for Bitcoin and other chains: lightning.network

Smart Contracts

A brief introduction into smart contracts: wikipedia.org/wiki/Smart_contract

Nick Szabo introduced smart contracts to the world.

Ethereum

The number #2 project in crypto, Ethereum, is a layer 1 blockchain with a powerful virtual machine that allows the creation of smart contracts. Its token standard, ERC-20, has allowed numerous projects like Chainlink and Uniswap to create sizable ecosystems built on the Ethereum mainnet.

The basics of Ethereum's network structure and various other resources: ethereum.org/en/learn

Introduction into Solidity, Ethereum's novel programming language invented by Polkadot Creator Gavin Wood: docs.soliditylang.org/en/v0.8.13/

The Dangers of Crypto

This article provides find an in depth overview of the various crypto grifts discussed below.

Faketoshis and Bitcoin knockoffs

Craig Wright

He is an Australian con artist who was forced to flee his home country after falsifying supercomputer research in exchange for tax credits. He then began to publicly claim in 2016 that he was Satoshi Nakamoto, but has only provided forged documents as evidence.

Here are the best places to explore why Craig Wright is NOT the creator of Bitcoin:

Timeline of Craig Wright's fraud and debunking by investigative journalist Arthur van Pelt: seekingsatoshi.weebly.com

Arthur van Pelt also writes excellent articles on Craig Wright : mylegacykit.medium.com

coincontroversy.com of course :)

BSV (Bitcoin Satoshi Vision)

BSV is a Bitcoin cash fork attempting to follow the vision of Faketoshi Craig Wright. The extremely low exchange support and insistence on being the real Bitcoin, despite being a centralized Bitcoin Cash fork, shows its true nature.

Bitcoin Cash

While better than BSV, it's also advised to stay away from Bitcoin Cash due to its centralized nature.

Other Faketoshis

Jurgen Debo is a Twitter faketoshi using backdated PGP keys. Beware of donation requests, shilling attempts at various products, and alt accounts: twitter.com/realSatoshiN

Twitter Scam Bots

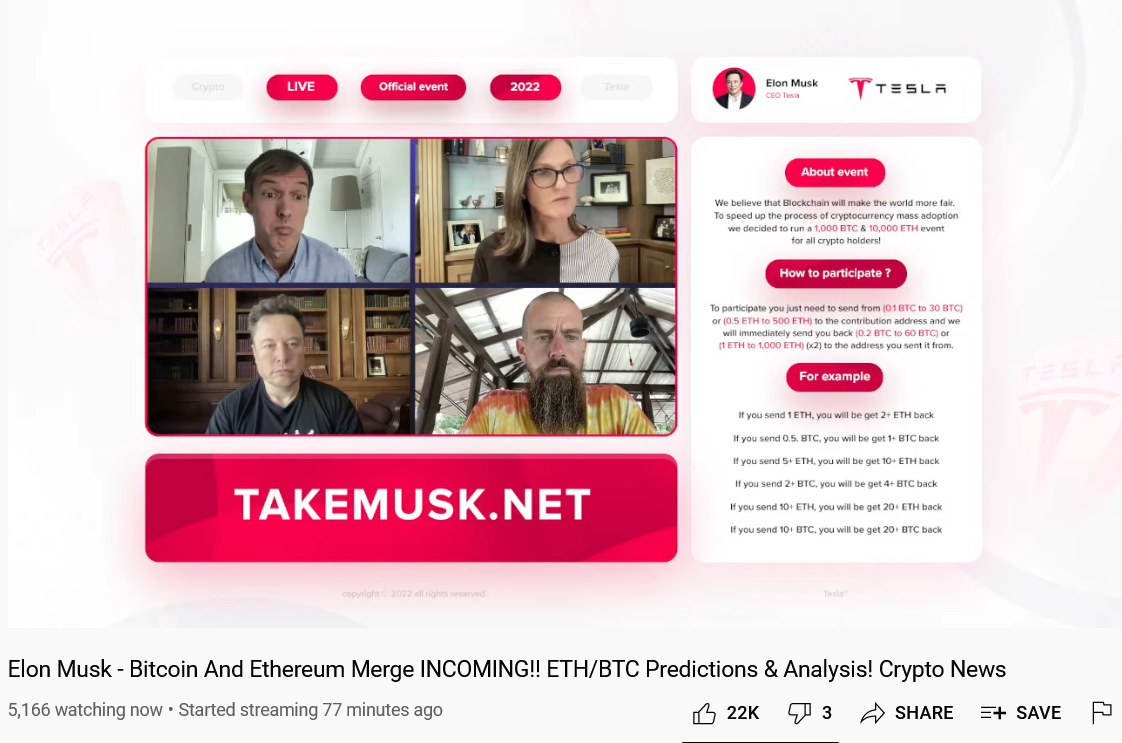

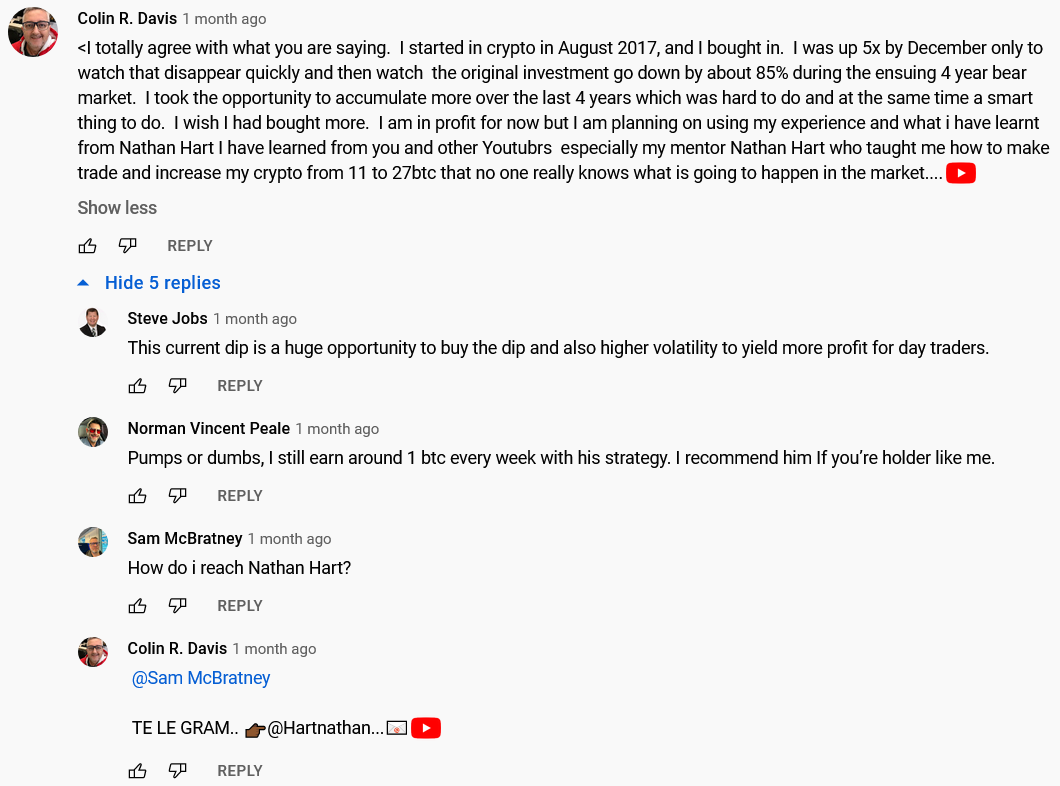

YouTube Scams

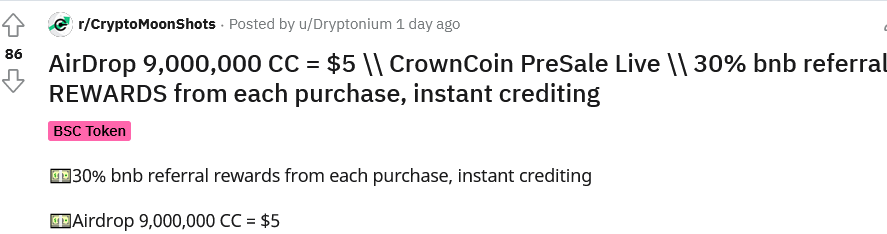

BNB Chain Scams

Case Study: Popular YouTuber Rug Pulls Supporters in $500k Token Scam

The CryptoMoonShots subreddit, where bots post scam tokens:

Other Helpful Resources

The Best Crypto News Aggregators

CryptoPanic: cryptopanic.com

Interesting Articles

Take a gander at these curated articles for a better look at different aspects of the cryptocurrency sphere!

In depth piece showing how to buy cryptocurrencies with a credit card: https://plasbit.com/blog/buy-crypto-with-credit-card

Article on how how to detect underrated projects: https://plasbit.com/blog/next-penny-cryptocurrency-to-explode-2024

*This page is updated with more resources over time.

*This article was updated on Oct 21, 2024