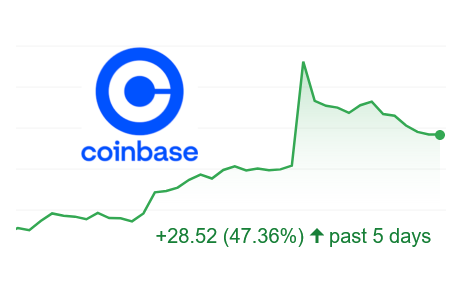

Coinbase Stock Rises 10% After Announcing New Partnership with BlackRock

Coinbase is recovering

Shares of Coinbase, the second-largest crypto exchange, have rocketed over 10% today after news of a partnership with institutional investor BlackRock. Dropping along with the rest of the market in recent months, this is a major recovery, with the stock rising off lows to around $89.

The deal involves BlackRock using Coinbase Prime, which will "provide crypto trading, custody, prime brokerage, and reporting capabilities to Aladdin’s Institutional client base who are also clients of Coinbase." Aladdin is BlackRock's investment management platform. For now, it will only include Bitcoin services.

Given Coinbase's high exposure to altcoins, BlackRock will likely expand to them as time passes. The hesitation surrounding altcoins is likely due to the ongoing SEC probe into Coinbase's listings. Although, it is unlikely BlackRock would make such a major deal unless they assessed the risk of Coinbase being charged by the SEC as low.

A few rocky months

You may have heard about Coinbase a lot in the news lately. The largely negative news began in mid-June when a former product manager was arrested for insider trading. The scheme involved the manager giving his cousin knowledge about tokens prior to being listed, so they could buy immense amounts and sell it after the notorious "Coinbase pump," often seen in smaller cap listings.

Furthermore, it was revealed in late June that the SEC had opened an investigation into Coinbase on the grounds that securities disguised as currencies were listed.

This assertion by the SEC is based on the Howey Test, a method of determining whether a financial instrument fits the definition of a security based on different factors. The tokens in question were RLY, AMP, DDX, XYO, RGT, LCX, DFX, KROM, and POWR. In response to the investigation, Coinbase stated in a blog post:

"Coinbase does not list securities. End of story."

Bullish for the entire industry

Despite some recent issues, Coinbase appears to be regaining its footing. This deal with BlackRock is bullish for the entire crypto industry, as institutional investors gaining exposure to Bitcoin and altcoins is often seen as one of the necessary steps for mass adoption.

Despite this, it is important to exercise caution, since BlackRock's influence can often be too strong; as shown by their aggressive purchasing in the housing market.