Learn

This page contains valuable resources to help navigate you through the basics of Bitcoin, smart contracts, and other top projects, as well as help you avoid common pitfalls of the blockchain industry.

Table of Contents

Bitcoin

Bitcoin is the world's first cryptocurrency developed in 2008 by Satoshi Nakamoto with a focus on security, decentralization, and social scalability. As a result of Bitcoin's strong economics and powerful immutable properties like Nakamoto consensus, it has remained the #1 cryptocurrency by market cap.

The ethos of Bitcoin is rooted in limiting network changes and keeping as many full nodes as possible to minimize trust and ensure decentralization on a global scale.

Possible origins

Importantly, the precursors of Bitcoin were devised by extropians involved in the cypherpunk movement. It all began on the private Libtech mailing list, started by Nick Szabo, who invited fellow cypherpunks Hal Finney, Wei Dai, and Tim May, as well as economists George Selgin and Larry White, to join as recipients. The Libtech mailing list happens to be where Szabo invented Bit gold and Dai invented B-Money.

Satoshi Nakamoto is a mysterious individual who shielded his identity through strong OPSEC skills. However, the most convincing evidence appears to point in the direction of the West Coast and the same circle that introduced Bitcoin's core ideas. Fascinatingly, B-Money was cited by Satoshi in the Bitcoin whitepaper, while Bitcoin's far closer analog, Bit gold, was not.

This is broadly seen as strange because Szabo asked for Bit gold contributors in a blog post 6 months before the paper's release, but also implied that someone other than the government should implement a currency better than Bit gold. Details like these resulted in extensive research I conducted into Szabo's possible role in the creation of Bitcoin, where I demonstrated his highly unique timing and motivations.

While I showed Szabo's work is undeniably the most important step towards Bitcoin, we will likely never know the full story. Whoever Satoshi is, he did an impressive job of creating the most secure, trust minimized monetary instrument in history.

Security

Besides its verifiable scarcity (which I touch on next), Bitcoin's success is linked to its immense level of security. Bitcoin achieves its impressive security through a breakthrough in distributed network research called Nakamoto Consensus, which was designed by Satoshi Nakamoto.

Specifically, Nakamoto Consensus is Bitcoin's consensus protocol that involves miners competing to solve a timestamped proof-of-work (PoW), which adds a block of transactions to the never-ending cryptographic hash chain. This approach establishes the longest chain of PoW as the authoritative chain, making it difficult for attackers to launch a 51% attack, due to requiring over 51% of the network's mining power to create a longer chain.

Economics

Bitcoin's design follows a unique form of Austrian economics, which was brought to the world by Nick Szabo. Specifically, Szabo extended the famous Austrian economists Ludwig von Mises and Carl Menger.

In 2002, Szabo published a monumental paper, "Shelling Out: The Origins of Money," outlining how ancient civilizations utilized trust minimized, decentralized, and unforgeably costly money, such as shells and precious metals. This quote from the piece serves as a perfect analog for Bitcoin's economic model:

"A collectible was not just any kind of beautiful decorative object. It had to have certain functional properties, such as the security of being wearable on the person, compactness for hiding or burial, and unforgeable costliness. That costliness must have been verifiable by the recipient of the transfer – using many of the same skills that collectors use to appraise collectibles today."

To tie in Bitcoin, miners in a decentralized network expend energy (establishing cost) to solve a timestamped proof-of-work puzzle, adding a block of transactions to the perpetual chain and receiving BTC as a reward (also through transaction fees). Bitcoin's unforgeable costliness demonstrates that the supply curve is constrained and along with the programmed supply cap of 21 million BTC, leads to a provably scarce currency that appreciates over time.

Furthermore, Bitcoin adjusts for inflation through halvings, which ensure stability and growth by reducing the block reward by half roughly every 4 years. This will continue until there is no more Bitcoin left to mine in 2140, when transaction fees will serve as the main incentive for miners.

Full nodes (part of a growing network) further decentralize the network by verifying transactions and blocks while keeping full copies of the blockchain. Decentralization is vital to maintain Bitcoin's monetary properties and ensure censorship resistance.

Bitcoin's design proves that the coins were not forged and thus minimizes trust by not relying on a central authority to issue the money. In addition, like the trust minimized money of old, Bitcoin's unforgeable costliness (through mining) and verifiable scarcity give it value, not aesthetics or central banks. Szabo strongly reiterates his theory 6 months before the whitepaper in "Bit gold Markets:"

"There are plenty of metals that are as shiny and smooth as gold, but people don't demand them as a store of value or medium of exchange because they are common. There are plenty of rocks that look as good as diamonds, but "diamonds are a girl's best friend" because they are hard to obtain and thus hold their value. Value comes to attach to the unique aesthetic features of gold or diamonds because these features signal scarcity... It is their secure scarcity, not their aesthetic features, that allows them to be more securely used as a store of value..."

You can see Satoshi using the same economic theory:

Social scalability

Nick Szabo has performed substantial research into social scalability, a key part of Bitcoin's success. Szabo described this crucial concept in a 2017 blog post:

"Social scalability is the ability of an institution –- a relationship or shared endeavor, in which multiple people repeatedly participate, and featuring customs, rules, or other features which constrain or motivate participants’ behaviors -- to overcome shortcomings in human minds and in the motivating or constraining aspects of said institution that limit who or how many can successfully participate."

Bitcoin is not successful because of its computational scalability, which is intentionally poor. Its success is rooted in the fact that users do not have to deal with human bottlenecks like middlemen and on-chain governance, leading to the greatest social scalability seen in any currency in history. For example, Alice in Europe could send Bitcoin to Bob in South America through the Lightning Network at quick speeds for a few pennies without any government or other human intervention.

When trust is minimized, a blockchain like Bitcoin avoids human limitations and achieves massive success through automation and strong monetary properties. On the contrary, many altcoins have on-chain governance structures with human participants. The problem is, when you incorporate such designs into the protocol, you often lose social scalability due to a "Lord of the Flies" scenario where governance participants fight over leadership and other important issues. I wrote about a proof-of-stake altcoin exhibiting this behavior here.

Hello Kitty people

In a 2006 blog post, Nick Szabo coined the term, "Hello Kitty people," for individuals who would rather rely on faulty human decision making than algorithms for tools like the Google search engine. Szabo brilliantly emphasizes how automation has greatly benefited our species, like for example in medieval times when mechanical clocks replaced less-accurate time-keeping methods like sundials. Another example is when electrical telegraphy replaced older communication methods like message by horse in the 1840s.

We can see this same trend play out in Bitcoin. Rather than trusting the erroneous decision making of central banks, which can lead to hyperinflation at any time, Bitcoin automates the process through a programmed 21 million supply cap, utilizing a distributed network of computers to reach consensus.

Companies/Organizations

There are several great companies in the Bitcoin industry that are worth paying attention to. Chief among them is JAN3, an international Bitcoin company that I have been reporting on since early 2023. Led by Samson Mow, the former Chief Marketing Officer of Blockstream, JAN3 specializes in software tooling, infrastructure, and research for Bitcoin. Mow is instrumental in leading talks with nation states to expand global Bitcoin adoption. Further, Nick Szabo made huge news when he joined JAN3 as its Chief Science Officer and is expected to transform the research taking place at the firm.

An example of the skillful work coming from JAN3 is the Madeira economy transitioning to be Bitcoin-based. Another impressive company is Michael Saylor's MicroStrategy, which is truly a force of nature. It has accumulated about 447,000 BTC at the time of writing this, making them the company with the biggest Bitcoin reserves by far.

Additional resources

- All the brilliant work that made Bitcoin possible 📚

- The whitepaper 📜

- Satoshi's body of work 🔥

- Brief introduction of the Lightning Network, a layer 2 scaling solution for Bitcoin and other chains ⚡

- Nick Szabo's Essays, Papers, and Concise Tutorials as well as his blog, Unenumerated 🌟

Smart contracts

Smart contracts are self-executing computer programs, automatically enforcing and facilitating agreements or transactions between parties according to predefined rules and conditions. Nick Szabo introduced the phrase and concept of smart contracts to the world in 1994.

Altcoins

Simply put, altcoins are cryptocurrencies that are not Bitcoin. A well known example is the number #2 project in crypto, Ethereum, a layer 1 blockchain with a virtual machine that allows the creation of smart contracts. There are many types of altcoins, but I focus on robust cryptocurrencies with clear advantages, such as Monero.

Introduction into Solidity, Ethereum's novel programming language invented by Polkadot Creator Gavin Wood

Interesting Altcoins

Altcoins in this section have honest roots and strong use cases.

Monero is without a doubt the king of privacy and extremely decentralized.

DigiByte is a fascinating Bitcoin fork that provides privacy, speed, and decentralization.

Grifts, Faketoshis, and Bitcoin knockoffs

This article provides find an in depth overview of the various crypto grifts discussed below.

Craig Wright

Wright is Australian con artist who fled his home country after falsifying supercomputer research in exchange for tax credits. He is well known for falsely claiming to be the creator of Bitcoin and is the poster child of Bitcoin Cash fork, BSV. Instead of signing a message with Satoshi's private key, he has provided only forged documents as evidence, which landed him a major court loss after COPA sued him.

Here are the best places to explore why Craig Wright is NOT the creator of Bitcoin:

- Timeline of Craig Wright's fraud and debunking by investigative journalist Arthur van Pelt: seekingsatoshi.weebly.com

- Arthur van Pelt also writes excellent articles on Craig Wright: mylegacykit.medium.com

- coincontroversy.com of course :)

BSV (Bitcoin Satoshi Vision)

BSV is a centralized Bitcoin cash fork attempting to follow the vision of Faketoshi Craig Wright. The common insistence on it being the real Bitcoin from participants, as well as Faketoshi fanaticism shows its true nature.

Bitcoin Cash

While better than BSV, it's also advised to stay away from Bitcoin Cash due to its centralized nature.

Other Faketoshis

There are many other Faketoshis, which I have reported on. A prime example is Jurgen Debo, a Twitter Faketoshi using backdated PGP keys. Beware of donation requests, shilling attempts at various products, and alt accounts.

X (Twitter) scam bots

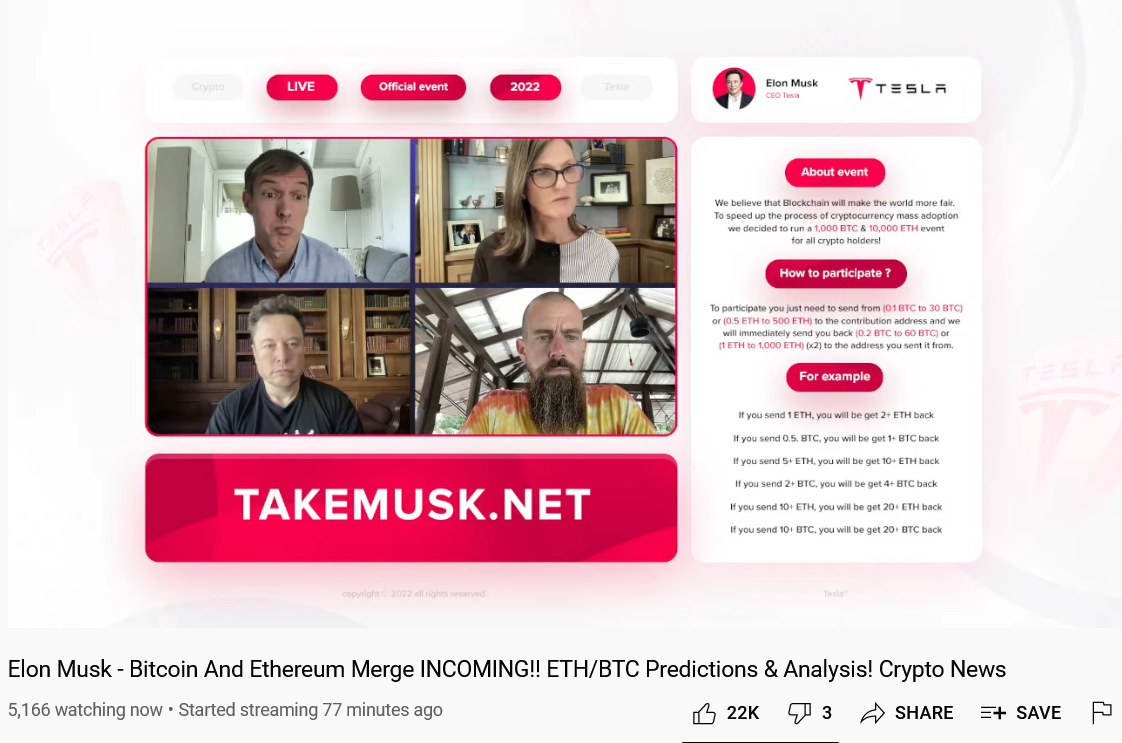

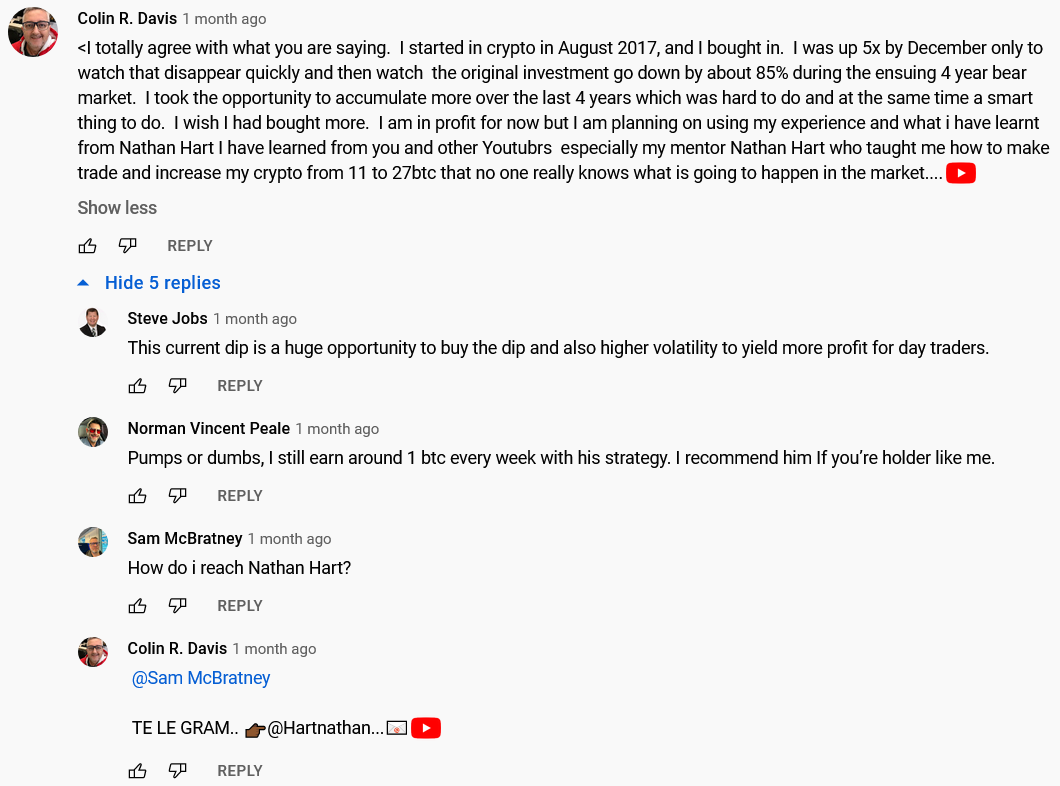

YouTube scams

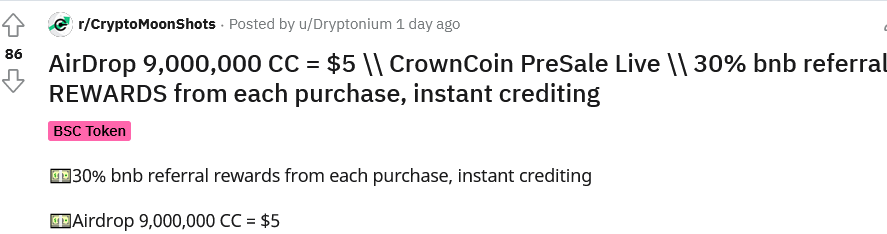

BNB Chain scams

Case Study: Popular YouTuber Rug Pulls Supporters in $500k Token Scam

The CryptoMoonShots subreddit, where bots post scam tokens:

Guides

Guide/story on how to avoid scams

Interesting articles

- In depth piece showing how to buy cryptocurrencies with a credit card

- Article on how how to detect underrated projects

*This page is updated with new information over time.

*This article was updated on Feb 20, 2025